TRUST WITH INDIVIDUAL TRUSTEE

CASE STUDY

Les is a plumber

To save costs associated with the setup, Les chose himself as trustee instead of a company, or corporate trustee.

A trust structure provides greater scope

After 2 years of independent contract plumbing work Les is offered a substantial plumbing contract for a unit development with 70 units. The contract would require him to supply all plumbing materials and engage a team of plumbers.

A trust structure also provides greater scope for further tax planning by interposing other entities, eg company or trust, as a beneficiary.

Problems

Les immediately realises that he needs to review his trust structure and replace himself as trustee with a company.

In doing so he can retain all his current ATO registrations, bank accounts and other business related contracts.

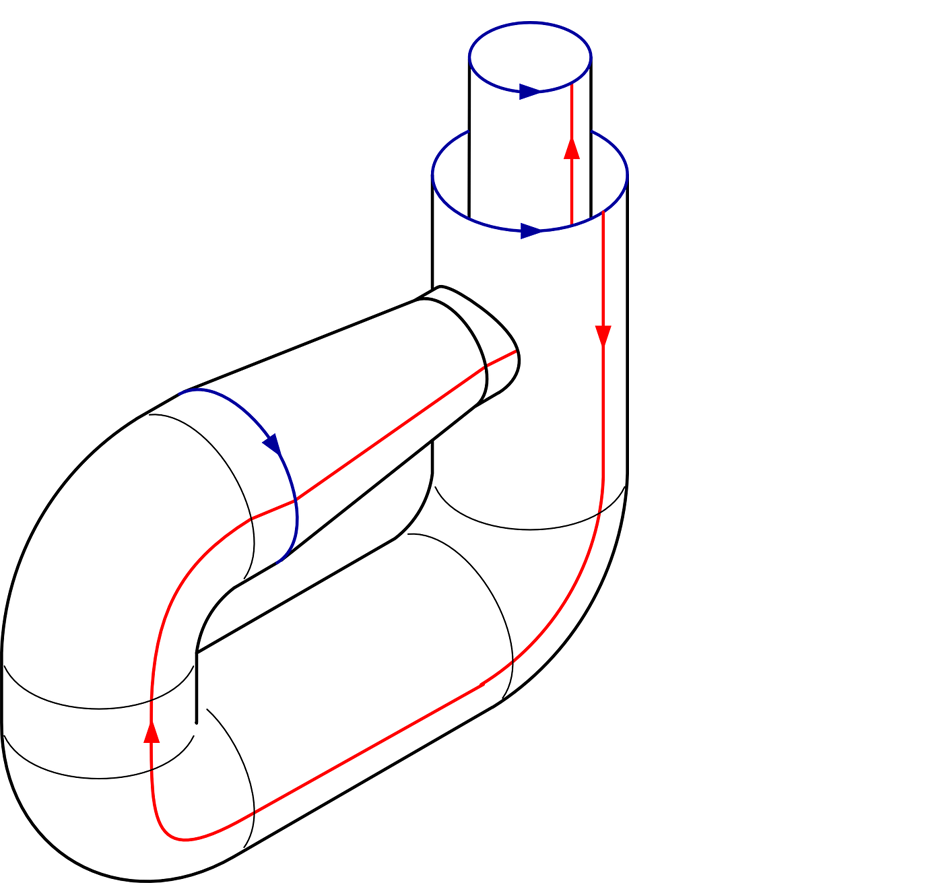

A Bit Messy

By Resolution – The schedule in the deed still shows the original trustee. A minute records the resignation and appointment. Any future financial or contractual arrangements must include the original deed and the minute – A bit messy.

A Cleaner Method

Deed of Variation – This is a separate legal agreement that varies the original trust deed. The deed of variation forms part of the documentation of the family trust and details how the trust deed has been changed. This is a cleaner method and one that most businesses will understand.